From a portfolio diversification perspective, fine art and antiques offer a solid hedge against the ups and downs of the traditional financial markets. As the global art market continues to grow, art and antique collectors are finding that high-quality pieces often outperform traditional investment options, offering both a sense of personal fulfillment and potential financial rewards.

January 2025

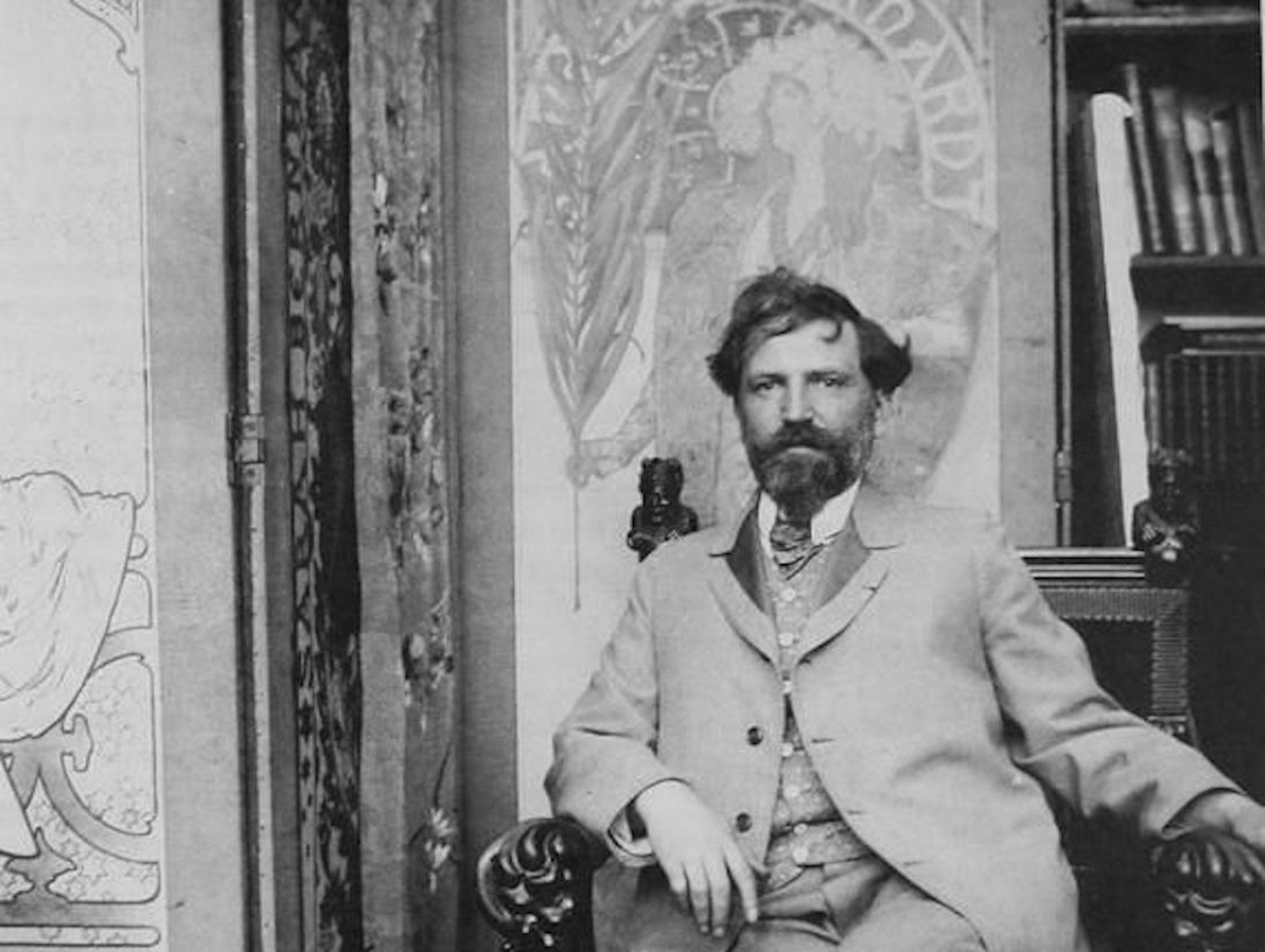

The Art of Sustainability: Investing in Timeless Masterpieces

Image credit: intdesigners.com

Collecting fine art and antiques has long been recognized as not only a passion for history and craftsmanship but also a strategic approach to diversifying and enhancing investment portfolios. As the financial landscape becomes more unpredictable, high-net-worth individuals and investors are increasingly turning to tangible assets like art and antiques as a way to hedge against market volatility, inflation, and other economic uncertainties. What many may not realize is that investing in these areas also supports a more sustainable form of investment.

Sustainability in the context of fine art and antiques can be understood in two ways. First, these items often have a longer lifespan than many other forms of investment, as they are made from durable materials and are designed to withstand the test of time. A well-maintained painting, sculpture, or antique piece can remain valuable for generations, thus promoting a form of investment that is not subject to the rapid depreciation associated with newer, mass-produced goods. In this way, the preservation of fine art and antiques contributes to sustainability by encouraging the longevity of items that are often passed down through families or institutions, rather than discarded or replaced.

Second, investing in fine art and antiques aligns with a growing movement toward more sustainable and conscious investing. With a focus on unique, handcrafted objects, many collectors are moving away from fast fashion or disposable items in favor of investing in works that have intrinsic historical and cultural value. This type of investment promotes a more mindful approach to wealth-building, where the appreciation of history and artistry is as important as financial returns.

From a portfolio diversification perspective, fine art and antiques offer a solid hedge against the ups and downs of the traditional financial markets. While stocks and bonds are subject to market fluctuations, the art and antiques market is often less correlated with traditional asset classes, meaning it can provide stability during periods of economic downturn. Moreover, these collectibles tend to appreciate over time, especially when they hold cultural, historical, or aesthetic significance.

Investing in fine art and antiques can also be a way to safeguard wealth across generations. As the global art market continues to grow, art and antique collectors are finding that high-quality pieces often outperform traditional investment options, offering both a sense of personal fulfillment and potential financial rewards. Not only can these investments be liquidated in times of need, but they can also increase in value as rare items become even harder to find.